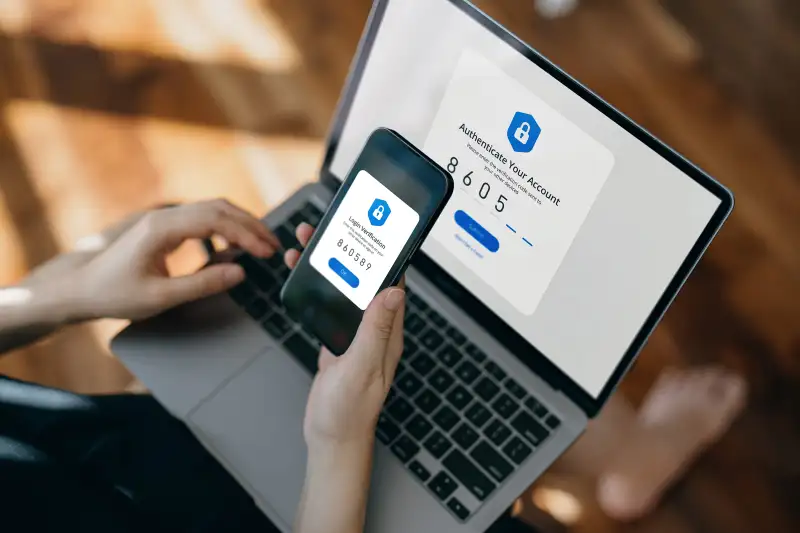

Two-factor authentication (2fa) is crucial for safeguarding online banking transactions. It adds an extra layer of security to online banking systems by requiring users to provide two forms of authentication to access their accounts.

Online banking has become a convenient way for people to manage their finances, but it also makes them vulnerable to cyberattacks. Hackers are always looking for ways to steal personal and financial information, and online banking is a prime target.

That’s why banks have implemented two-factor authentication (2fa) to protect their customers’ accounts. 2fa requires users to provide two forms of authentication before accessing their accounts. This means that even if a hacker manages to obtain the user’s login credentials, they still need to provide an additional authentication code sent to the user’s device to gain access. This added security measure has proven effective in thwarting cyberattacks and keeping financial transactions safe.

Credit: money.com

How 2Fa Works For Online Banking

Overview Of How 2Fa Works In General

Two-factor authentication (2fa) is a security method where users need to provide two different authentication factors to log in to their accounts. It adds an extra layer of security to protect users’ sensitive information from cyber threats.

Explanation Of How 2Fa Works Specifically For Online Banking

Online banking is a popular target for cybercriminals, hence why two-factor authentication is a crucial security feature for this service. Here is how 2fa works specifically for online banking:

Detailed Explanation Of The Two Factors Used In 2Fa For Online Banking

There are two main factors used in 2fa for online banking. These factors provide more secure identification of users and make it challenging for hackers to gain access to sensitive information.

Factor 1: Password

A password is the first factor in 2fa that you already know. It requires you to provide a password that is unique and strong enough to protect your account. Here’s to make sure that your password is strong and secure:

- Use a combination of uppercase and lowercase letters, numbers and symbols

- Avoid using full words and information that is easy to guess such as your name or date of birth

- Change your password regularly

Factor 2: One-Time Code

The second factor of 2fa is a one-time code authentication option. This code is generated either by a mobile application or a text message sent to the user’s mobile number. The following are some advantages of using one-time codes to validate login attempts:

- It is easy to use

- It can be sent to the user’s mobile phone so that login attempts can be validated remotely

- Each authentication code expires shortly after, making it challenging for hackers to use them

If the user successfully enters the correct password and the one-time code, they can log in to their account. Remember, two-factor authentication is an excellent method to secure your online banking, so it’s vital to enable this feature when given the option.

Types Of 2Fa Used In Online Banking

Two-Factor Authentication (2Fa) For Online Banking: Safeguarding Your Financial Transactions

In today’s digital era, online banking has become more prevalent than ever before. It is incredibly convenient, allowing us to handle our financial affairs with just a few clicks of a button. However, with this convenience comes a heightened risk of fraud and cybercrime.

This is where two-factor authentication (2fa) comes into play. 2fa adds an extra layer of security to online banking, ensuring that banking transactions are protected from potential cyber threats. In this post, we will discuss the different types of 2fa available to online banking customers, their pros and cons, and how they work to safeguard your financial transactions.

Explanation Of The Different Types Of 2Fa Used In Online Banking

There are three primary types of 2fa used in online banking: sms-based 2fa, app-based 2fa, and hardware token-based 2fa.

Sms-Based 2Fa

Sms-based 2fa is one of the most popular forms of 2fa used by banks across the world. This method involves receiving a unique code via sms on your registered mobile number, which is then entered into the online banking platform to verify your identity.

Key features of this type of 2fa are:

- The user must have access to their registered mobile number.

- Sms-based 2fa is easy to set up and execute.

- It is a cost-effective option and does not require any additional hardware or software.

However, sms-based 2fa does have its limitations:

- It is not the most secure method of 2fa as sms messages can be intercepted or manipulated.

- It is heavily dependent on the strength of the mobile network signal.

- Users may experience delays in receiving the sms message, which can be frustrating.

App-Based 2Fa

App-based 2fa is gradually gaining popularity among online banking customers. This method works by installing an app on your mobile device, which provides a secure and encrypted channel for authentication. Key features include:

- The app generates a unique code that is entered into the online banking platform.

- Some apps offer more security features, such as facial recognition or fingerprint authentication.

- App-based 2fa is more secure than sms-based 2fa.

However, app-based 2fa has its drawbacks:

- It requires internet connectivity to generate the code.

- Users need a compatible device to run the app.

- Upkeep and maintenance of the app may cause inconvenience.

Hardware Token-Based 2Fa

Hardware token-based 2fa is the most secure form of 2fa available for online banking customers. A hardware token is a small device that generates a unique code that is used for authentication. Key features of this type of 2fa include:

- Hardware tokens are not connected to the internet, making it impossible for hackers to intercept or manipulate any authentication requests.

- Hardware token-based 2fa does not require internet connectivity.

- It is more secure than sms-based and app-based 2fa.

However, hardware token-based 2fa comes with its own set of limitations:

- Hardware tokens can be costly compared to other types of 2fa.

- If the token is lost or damaged, the user may face inconvenience.

- It requires maintenance and proper upkeep to ensure that it functions properly.

Pros And Cons Of Each Type Of 2Fa

Each type of 2fa has its own set of pros and cons. Here is a summary of the advantages and disadvantages of each:

Sms-Based 2Fa

Pros:

- Convenient and easy to set up.

- Cost-effective as it does not require any additional hardware or software.

Cons:

- Not the most secure form of 2fa.

- Dependent on the strength of the mobile network signal.

- Users may experience delays in receiving the sms message.

App-Based 2Fa

Pros:

- Provides an extra layer of security, especially those that support facial recognition or fingerprint authentication.

- More secure than sms-based 2fa.

Cons:

- Requires internet connectivity to generate the code.

- Users need a compatible device to run the app.

- Upkeep and maintenance of the app may cause inconvenience.

Hardware Token-Based 2Fa

Pros:

- The most secure form of 2fa available for online banking customers.

- Not connected to the internet, making it impossible for hackers to intercept authentication requests.

Cons:

- Can be costly compared to other types of 2fa.

- If the token is lost or damaged, the user may face inconvenience.

- Requires maintenance and proper upkeep to ensure that it functions properly.

Two-factor authentication (2fa) is an essential tool for safeguarding your financial transactions online. With different types of 2fa available, it is essential to choose a method that suits your needs. While sms-based 2fa is the most straightforward and affordable option, it is becoming less popular due to its lack of security.

App-based 2fa offers more security features but requires a compatible device and internet connectivity. Hardware token-based 2fa is the most secure but is costly and requires maintenance.

Setting Up 2Fa For Online Banking

Two-Factor Authentication (2Fa) For Online Banking: Safeguarding Your Financial Transactions

Online banking has revolutionized the way we carry out financial transactions. However, it has also given rise to online frauds and identity theft. This is where two-factor authentication (2fa) comes in to serve as a cybersecurity measure. By setting up 2fa for online banking, users add an extra layer of security to their accounts.

In this blog section, we will explain how to set up 2fa for online banking, how to set it up for specific banks, and address some common issues users face when setting up 2fa.

Steps To Setting Up 2Fa For Online Banking

Setting up 2fa for online banking is a simple process that can be accomplished in a few simple steps. Here are the key steps to follow:

- Log in to your online banking account

- Navigate to the security settings

- Choose two-factor authentication (2fa) as your preferred security option

- Follow the prompts to set up 2fa

Explanation Of How To Set Up 2Fa For Specific Banks

Different banks have different procedures for setting up 2fa. Here’s how some popular banks do it:

Bank Of America

- Log in to your online banking account

- Go to the profile and settings link

- Choose security and settings and scroll down to two-step verification

- Follow the prompts to complete the setup process

Wells Fargo

- Log in to your online banking account

- Navigate to the my profile and settings link

- Choose get started with enhanced login security and follow the prompts to set up 2fa

Chase

- Login to your online banking account

- Go to the profile and settings link

- Choose security and scroll down to two-step verification

- Follow the prompts to complete the setup process

Common Issues Users May Face While Setting Up 2Fa And How To Address Them

While setting up 2fa may appear easy, some users may encounter common difficulties. Here are some of the issues and how to address them:

- Incompatibility of the 2fa app with the banking app: In such scenarios, try using an alternative 2fa app.

- Difficulty scanning the qr code: Try repositioning the qr code or increasing the brightness on the screen.

- Forgotten passwords: Set up password recovery options before setting up 2fa.

- Timing out during 2fa setup: Restart the setup process from the beginning.

To sum up, setting up 2fa for online banking is essential in securing your financial transactions. By following the simple steps outlined in this section, users can easily set it up for their accounts, regardless of the banking institutions they use.

Frequently Asked Questions For Two-Factor Authentication (2Fa) For Online Banking: Safeguarding Your Financial Transactions

What Is Two-Factor Authentication (2Fa)?

2fa is a security feature that adds an extra layer of protection to your online accounts by requiring an additional verification code.

How Does 2Fa Enhance Online Banking Security?

By requiring a second authentication factor, 2fa ensures that only authorized individuals have access to financial accounts, making it difficult for cybercriminals to gain access.

What Types Of Authentication Factors Are Used In 2Fa?

2fa commonly uses something you know (password), something you have (smartphone), or something you are (fingerprint) for additional verification.

Conclusion

Overall, two-factor authentication (2fa) is essential for safeguarding your online banking transactions. It provides an added layer of security that makes it more challenging for cybercriminals to gain access to your sensitive financial information. You must enable 2fa to protect yourself from identity theft, unauthorized access, and other online fraud activities.

It is necessary to note that 2fa is not perfect, but it is still a significant improvement over traditional methods of authentication such as passwords. Be sure to use a reputable bank that offers robust security features like 2fa. Stay vigilant about protecting your information by checking your online bank accounts regularly and setting up alerts for any suspicious activity.

With these security measures in place, you can rest assured that your financial transactions are secure from cyber threats.