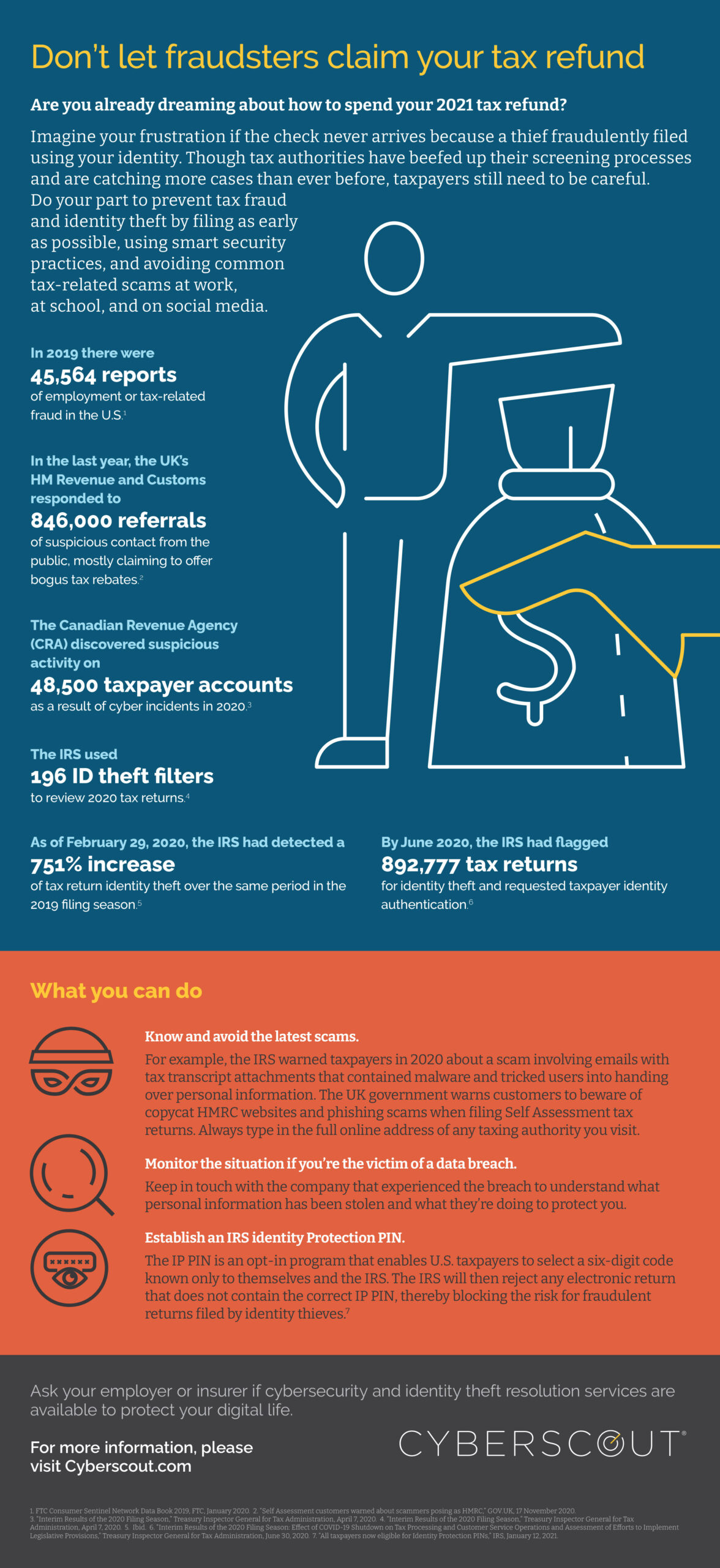

Protect your personal information and prevent identity theft and tax fraud during tax season by following these tips. Tax season brings an increased risk of identity theft and tax-related scam attempts, and it’s important to be aware of potential threats and take steps to protect your sensitive data.

Criminals may attempt to steal personal information such as social security numbers and use it to file fraudulent tax returns or commit other types of financial fraud. By staying vigilant and taking proactive measures, you can reduce your risk of falling victim to these schemes and enjoy a safe and secure tax season.

Credit: diamondcu.org

Understand The Risks

Identity theft and tax fraud are an all-too-common occurrence during tax season, with countless numbers of unsuspecting taxpayers falling prey to scammers. It is therefore imperative that you as a taxpayer take necessary precautions to secure your personal information and prevent any fraudulent activity.

Understanding the risks involved is the first step towards achieving this goal.

Explanation Of The Types Of Identity Theft And Tax Fraud That Commonly Occur During Tax Season

- Phishing scams: Scammers send fraudulent emails or make phone calls that appear to be from the irs, financial institutions, or tax preparation services, requesting sensitive information. Victims unwittingly provide their personal details such as social security numbers, passwords, and credit card information, leading to identity theft and tax fraud.

- Stolen identity refund fraud (sirf): This type of fraud happens when perpetrators use stolen information such as social security numbers and birth dates to file a tax return in someone else’s name and receive refunds. The victim remains unaware until they attempt to file their own tax return.

Overview Of The Tactics Used By Scammers

Scammers employ a variety of tactics to lure unsuspecting taxpayers into divulging personal information:

- Impersonating the irs: Scammers pretend to be from the internal revenue service (irs) or other legitimate financial institutions to obtain sensitive information.

- Creating fake websites and emails: Scammers create fake emails or websites that appear to be legitimate government agencies to trick people into providing sensitive information.

- Using social engineering tactics: Scammers use social engineering tactics such as posing as a friend, acquaintance, or company representative to encourage people to reveal personal information.

Red Flags To Watch Out For When Filing Taxes

It is important to be vigilant and watch out for any suspicious activity when filing taxes. Here are some red flags to be aware of:

- Spelling errors and typos: Official government communication is typically free of spelling errors and grammatical mistakes. If you notice any errors in official emails or letters, be wary.

- Pressure to respond quickly: Scammers often create a sense of urgency to make you act quickly. Be cautious of any emails or phone calls that require an immediate response.

- Requests for personal information: Legitimate institutions and organizations will not request sensitive information such as social security numbers, bank account details, or passwords over the phone or via email.

Identity theft and tax fraud pose significant risks during tax season. Understanding the types of fraud and tactics employed by scammers, and watching out for red flags, can help protect you from becoming a victim. Stay vigilant and trust your instincts when it comes to divulging personal information.

Protect Your Information

Identity theft is a severe issue that can cause a lot of trouble for victims. Unfortunately, tax season is a prime time for identity thieves to steal personal information and use it to file fraudulent tax returns. Protecting your personal information and staying vigilant against scams and phishing attempts are essential during tax season.

In this post, we’ll cover some best practices for protecting your information, securing online tax filing, and avoiding phishing scams.

Best Practices For Protecting Personal Information

- Keep sensitive documents in a safe place, such as a lockbox or password-protected digital folder.

- Shred any paperwork that contains personal information before throwing it out.

- Use unique and strong passwords for all online accounts.

- Avoid sharing personal information over the phone or through email unless you initiate the contact and are sure it’s secure.

- Don’t carry your social security card with you, and only provide it when absolutely necessary.

How To Secure Online Tax Filing

- Use a secure internet connection when filing taxes online, preferably a private wi-fi network.

- Update your computer’s security software and keep it up to date.

- Ensure the website you’re using to file your taxes is legitimate and secure

- Avoid using public computers to file taxes or accessing sensitive information.

Tips For Avoiding Phishing Scams And Other Common Tactics Used By Scammers

- Use caution when opening emails or clicking on links, especially if they’re from an unknown sender.

- Don’t fall for phone or email scams that claim to be the irs or a tax preparation service.

- Report any suspicious activity to the irs or other relevant authorities.

- Keep an eye on financial accounts and credit reports for signs of fraudulent activity.

Following these tips can help protect your personal information and keep you safe from identity theft and tax fraud during tax season and beyond. Stay vigilant and take action if you suspect any suspicious activities to ensure that you stay ahead of any potential threats.

What To Do If You Experience Identity Theft Or Tax Fraud

Identity theft and tax fraud: tips for a secure tax season

Tax season can be a stressful time for most people, especially if they suspect or are victims of identity theft or tax fraud. It can lead to significant financial losses and put your personal information in danger. In this section, we will discuss what to do if you experience identity theft or tax fraud during tax season.

Steps To Take Immediately If You Suspect Identity Theft Or Tax Fraud

If you suspect that you are a victim of identity theft or tax fraud, it is crucial to act quickly. Here are some immediate steps you can take:

- File a report with the federal trade commission (ftc) by visiting identitytheft.gov or calling 1-877-438-4338. The ftc can help you create a recovery plan and provide additional resources.

- Contact one of the three major credit bureaus (equifax, experian, and transunion) and place a fraud alert on your credit report. This alerts creditors to verify your identity before opening new accounts in your name.

- Contact your bank, credit card company, and other financial institutions where you have accounts. Inform them of the situation and request that they monitor your accounts for any suspicious activity.

- Contact the irs identity protection specialized unit at 1-800-908-4490. The irs can assist you with next steps and help protect your tax account.

- File your tax return as soon as possible to prevent further damage.

Overview Of Options For Recourse And Recovery

Once you have taken immediate steps to protect yourself, you may want to seek further recourse or recovery options. Here are some options available to you:

- Contact the irs if you have received a notice or letter from them regarding suspicious activity on your tax account.

- File an identity theft affidavit (form 14039) with the irs. This form alerts the irs that you have been a victim of identity theft, and they will take additional steps to protect your account.

- Consider placing a credit freeze on your credit reports. This prevents anyone from accessing your credit report without your permission.

- Consult with a tax professional or attorney to determine if you have any legal recourse against the person who stole your identity.

Best Practices For Avoiding Future Incidents

It is important to take steps to avoid becoming a victim of identity theft or tax fraud in the future. Here are some best practices you can follow:

- Do not give out personal information unless you know and trust the person or company requesting it.

- Use strong, unique passwords for all accounts and update them regularly.

- Monitor your credit reports regularly to ensure that there are no unauthorized accounts or activity.

- Be cautious of phishing scams, where scammers try to obtain sensitive information through fake emails or websites.

- Consider using a reputable identity theft protection service to monitor your accounts.

By following these steps, you can protect yourself from identity theft and tax fraud during tax season and beyond. Remember to act quickly, seek additional recourse if needed, and implement best practices to prevent future incidents. Stay vigilant and protect your personal information.

Frequently Asked Questions For Identity Theft And Tax Fraud: Tips For A Secure Tax Season

What Is Identity Theft?

Identity theft is when someone steals personal information and uses it to commit fraud.

How Can I Protect My Identity During Tax Season?

File your taxes as early as possible, use a secure internet connection, and don’t give out personal information over the phone or email.

What Should I Do If I Think I’Ve Been A Victim Of Tax Fraud?

Contact the irs immediately, place a fraud alert on your credit reports, and review your credit reports for any suspicious activity.

Conclusion

Identity theft and tax fraud are serious issues that can cause significant harm and financial losses to individuals. It is crucial to be vigilant and take proactive measures to protect your identity and secure your tax information during tax season.

By following the recommended tips in this blog post, such as using multi-factor authentication, monitoring your credit report, and encrypting your tax information, you can minimize your risk of becoming a victim of tax fraud and identity theft. Remember to always be cautious and never disclose personal information to unsolicited individuals through email or phone calls.

By staying informed and taking preventive actions, you can ensure a safe and secure tax season while focusing on what matters most – maximizing your tax returns.